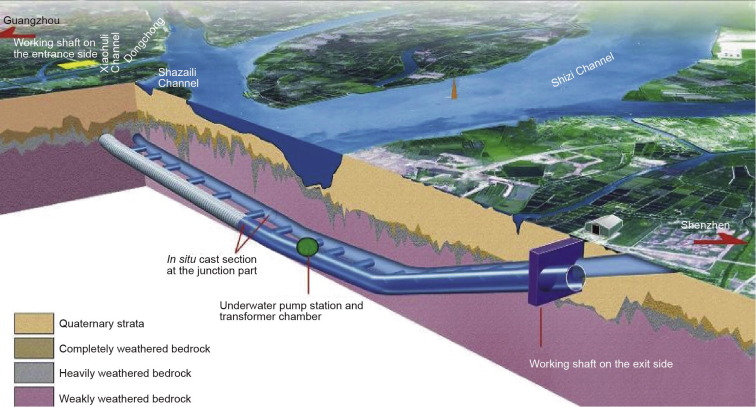

Funding for the construction of Xiamen Xiang’an Tunnel

5 min readThe project financing of Xiamen East Passageway(Xiang’ an Tunnel) started in 2003. Along with the replacement of assets of Xiamen Two Bridges(Xiamen Bridge and Haicang Bridge, the same below) and the toll reform work of the passages in and out the island, there had been ups and downs in the project financing of the Xiangan Tunnel Project.

In early 2003, when the Xiamen East Passageway Project financing work started, the Xiamen Municipal Government proposed the idea of reforming the toll collection system of the two bridges.In order to coordinate with the reform of the toll collection system of the two bridges, the assets of the two bridges should be swapped out from the Xiamen Road & Bridge Construction Investment Co., Ltd. to be used as the business assets of the Xiamen Road & Bridge Construction Group Co., Lt When the government arranged the project fund of Xiangan Tunnel, it also arranged the project fund of Xiangan Highway and Shuiliuxian Project, and merged the Xiang’ an Tunnel, Xiang’ an Highway and Shuiliuxian Project into the Xiamen East Passageway Project, which means the project financing of Xiangan Tunnel was also the project financing of the Xiamen East Passageway Project.It was estimated the investment in Xiang’ an Tunnel would be 3.165 billion Yuan, the investment inthe supporting project Xiangan Highway and Shuiliuxian Project would be 0.8 billion Yuan, and the total financing would be 3.965 billion Yuan.

According to China’s regulations on project capital, the East Passageway Project needs to raise 1.365 billion Yuan. The determined project capital sources were 0.35 billion Yuan of the income of the toll from the “Two Bridges”during the East Passageway construction,0.25 billion Yuan using national debt subsidies,0.15 billion Yuan using transportation subsidies, and 0.1 billion Yuan using transportation war readiness subsidies, which, altogether, in total equals 0.85 billion Yuan. Facing a shortfall of 0.515 billion Yuan, they planned to issue corporate bonds(trust certificates).

For the remaining 2.6 billion Yuan not included in the project capital, the Xiamen Road & Bridge Group proposed a bundle which used three kinds of secured loan by electing to take an “underwritten syndicated loan”,a “club deal syndicated loan”and separate individual secured bank loans.

The “underwritten syndicated loan”was arranged by the Xiamen Road & Bridge Group.A number of lending banks and financial institutions signed one loan agreement and took the same security with one institution acting as the arranger who managed and collected the loan fund from the other banks for the borrower. This is a primary source of project financing in construction projects.

The “club deal syndicated loan”is a looser form of syndicated loan where a number of banks form a consortium and sign a unified loan agreement which has the same security and is signed by the borrower. It is also a major source for project construction financing.

The “individual secured bank loans”means that the management right of the three channels (the Two Bridges and Xiangan Tunnel) are separated for pledge and they take separate loans with their own security from different banks and repay the debt together.

The debt repayment of the East Passageway in the future would mainly come from the toll of Haicang Bridge and Xiamen Bridge, and the toll of Haicang Bridge and Xiamen Bridge was also the debt repayment source of Haicang Bridge. Therefore, if the Bank of China acted as the leading bank it would provide better continuity. The Bank of China could also give positive and preferentialpolicies in pre-credit limit, bridge loans, interest rate, term, withdrawals, payments, reduction of front-end fees, and agency fees.

At this point, the financing scheme of the Xiamen East Passageway Project had been finalized.The shares of syndicated loans were as follows: Bank of China,900 million Yuan; China Development Bank,800 milion Yuan; Industrial and Commercial Bank of China, Agricultural Bank of China, and Construction Bank,300 million Yuan respectively.

To support the construction of Xiamen East Passageway, the Xiamen Municipal Government agreed to lift the controls over Xiamen Road & Bridge Group’s operating period of the three passages.Before all debts were paid off, there would be no limit on the number of years the toll would be in operation. It promised that if there were adverse effects caused by the new construction of passages in and out the island, by the adjustment of the toll policy or by exceeding the budget estimate or there were delays caused by the unforeseen factors such as technology gaps, the government would take appropriate compensatory measures to ensure that the project financing was repaid.

With the support of government credit, the syndicated assessment work was carried out smoothly. After the members reported to their head offices for approval, they signed the Xiamen East Passageway Project syndicated loan agreement with Xiamen East Road and Bridge Group on April 30,2005. Thus, the syndicated loan of the Xiamen East Passageway Project was successfully completed.

As policies changed, the East Passageway project capital had some deficiencies. Xiamen Road& Bridge Group decided to issue 800 million Yuan of corporate bonds in order to raise capital for the East Passageway Project.

Approved by the Xiamen Municipal Government, in early 2005, Xiamen Road & Bridge Group began to plan for the issuance of corporate bonds. With great support from the Xiamen Municipal Government, more capital was raised in 2004 and 2005 in line with financial regulations governing the issuance of corporate bonds. Approved by the National Development and Reform Commission,0.8 billion Yuan of corporate bonds was successfully issued on June 20,2006, with a term of 15 years and interest rate of 4.25%, which was nearly one of the lowest rates ever seen.

The 0.8 bilion Yuan of corporate bonds for the East Passageway not only solved the project capital gap, but also promoted the perfection of company financing system, broadened the financing channels, and reduced financing costs, which laid a foundation for the continued financing of the Xiamen Road & Bridge Group. The external constraint mechanism was preliminarily introduced, which promoted the company’s operation and management level and actively propelled the innovation in its management system.

So far,0.8 billion Yuan of corporate bonds,0.234 billion Yuan of subsidy from the Ministry of Transportation, the toll income from the Two Bridges, and other funds raised by Xiamen Road& Bridge Group had fully implemented the capital for the East Passageway project.